Docs

Contents:

Budgeting

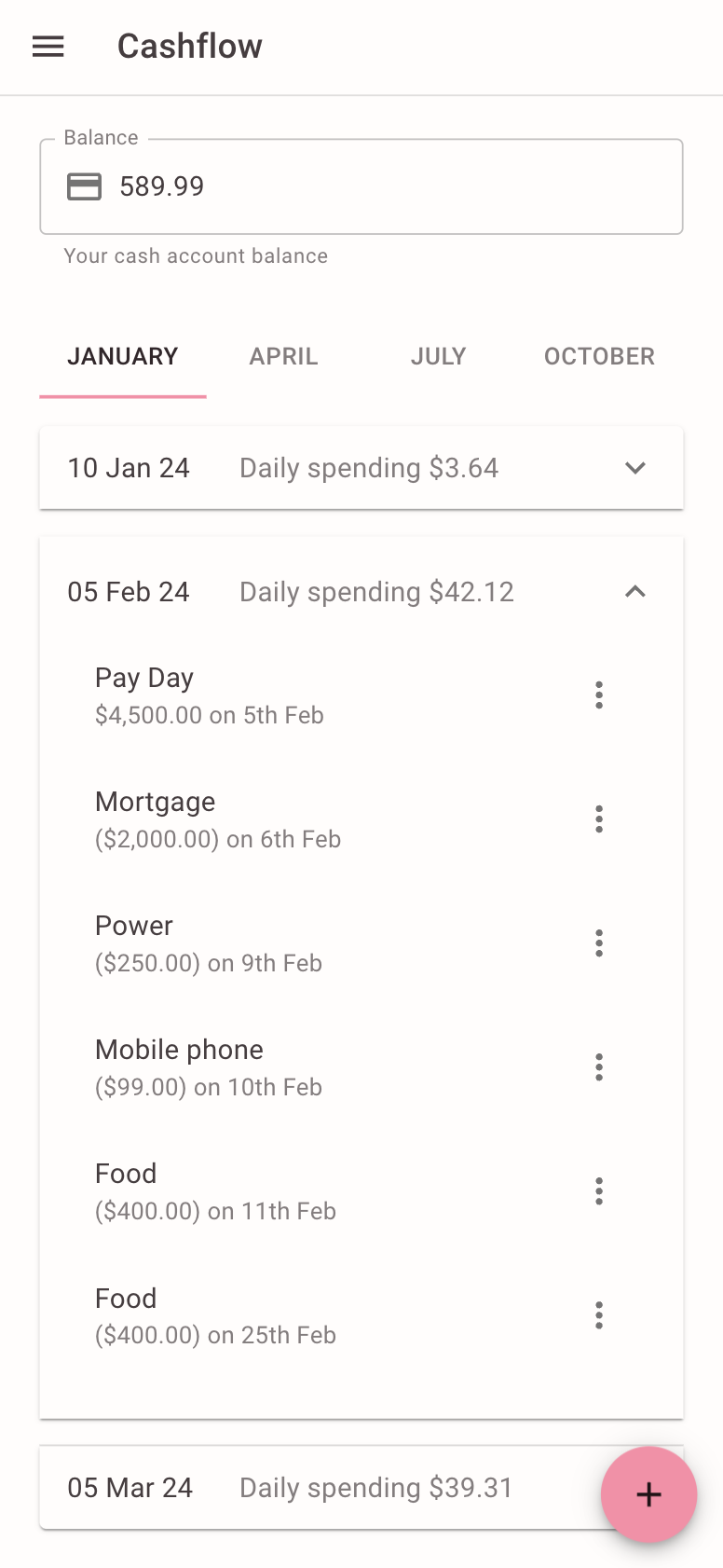

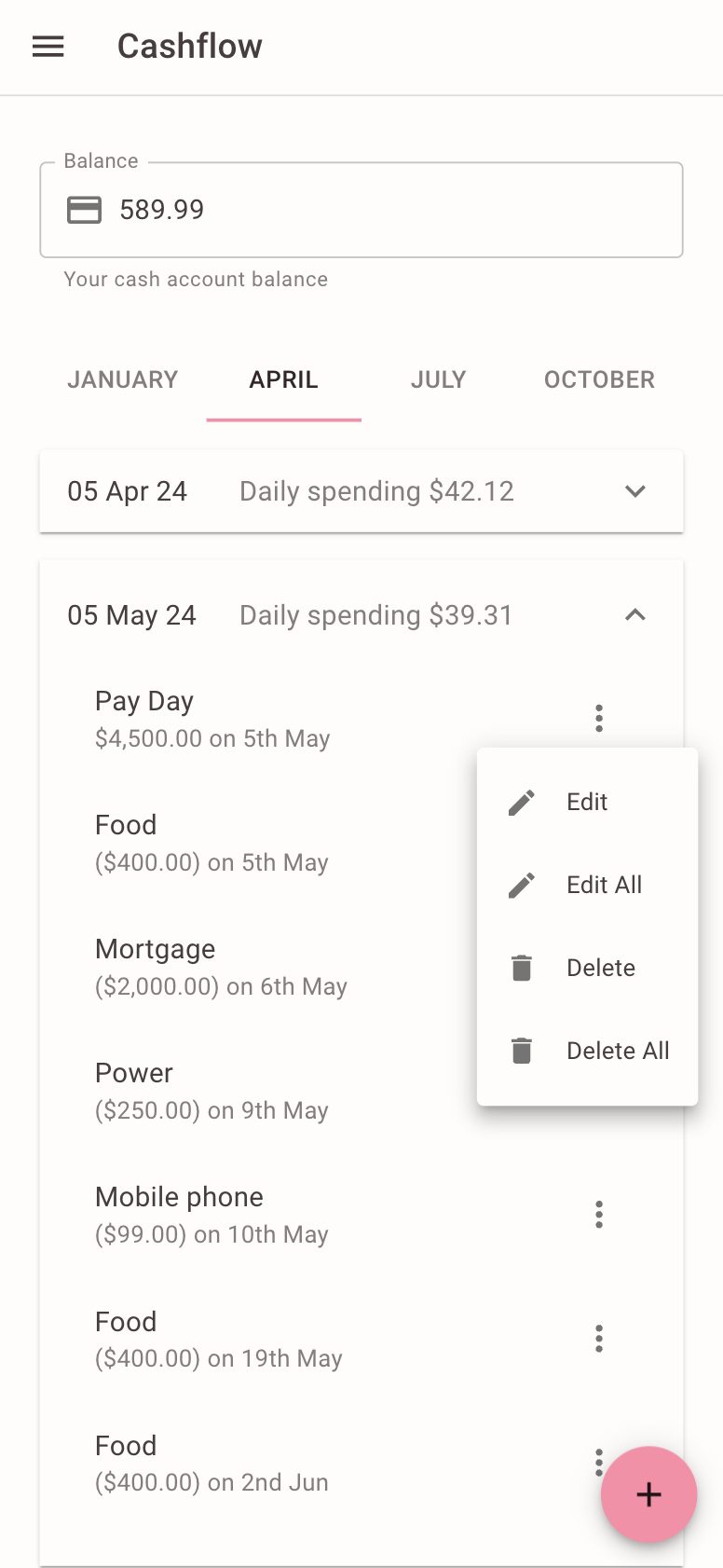

You can use the Cashflow screen to maintain a forward looking view of your income and expenses. A daily allowance is calculated and will automatically adjust as your update your budget, so that you always know how much you can safely spend.

Overview

On the Cashflow screen, click the large Plus button to add your recurring income and payments to your budget and Cashflow will automatically forecast your budget for the next 12 months.

If you add a recurring item that has a transaction type of Income, then Cashflow will break your forecast up into pay periods and calculate your daily spending money for each period.

Click on the tabs and panels shown below to view the items in your forecast.

Enter the balance from your main spending bank account and Cashflow will calculate the rest.

Adding Items

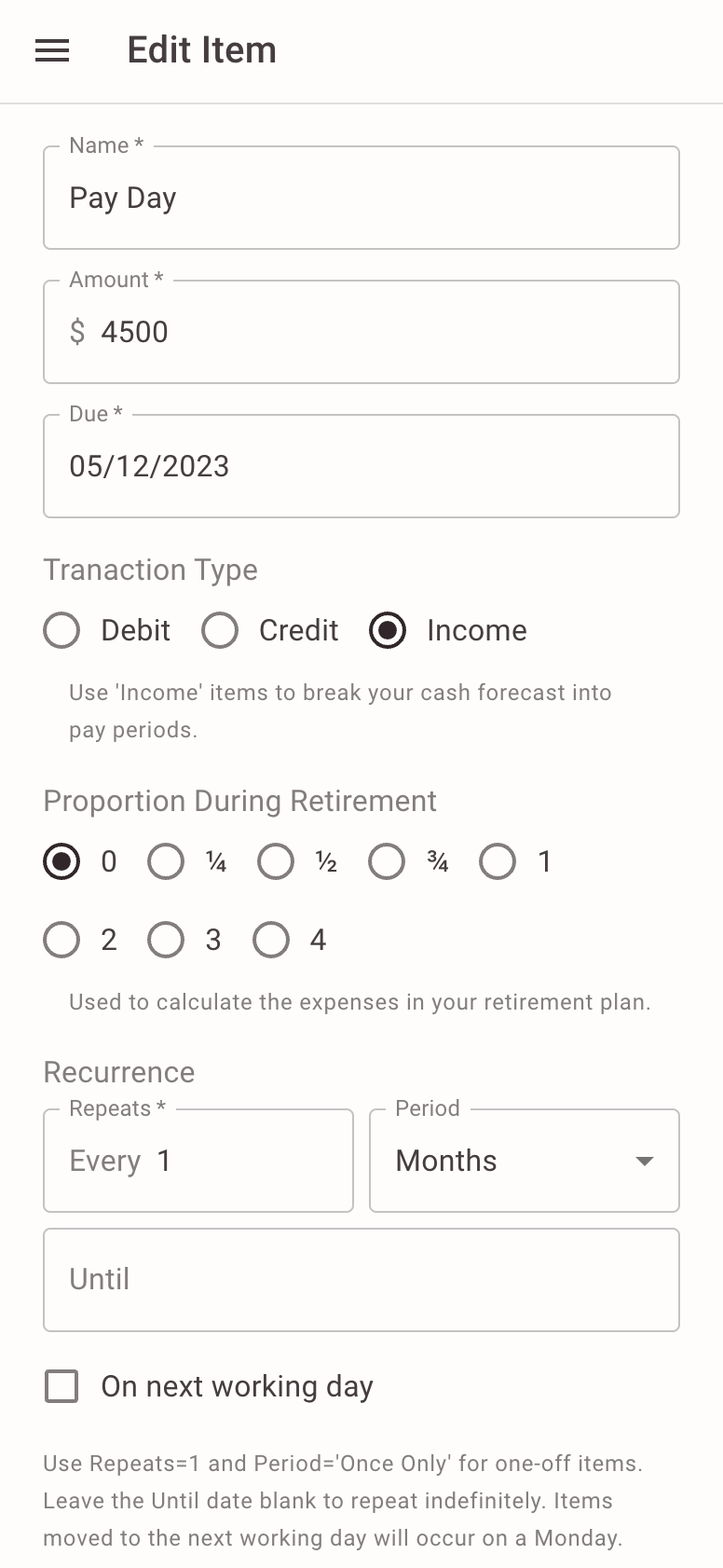

Adding and updating items should be quick and easy. We have minimised the amount of data entry required.

Key information:

- Transaction type - Will normally either be a Debit or Credit, like your bank account. Select Income for your main income payments. Your income items are used to break up the cashflow forecast into pay periods.

- Proportion during retirement - A rough estimate of how much of this item will be needed during retirement. Our retirement planning tool (comming soon) will use this information to help you plan for your retirement.

- Recurrence - Select a quantity and either Days, Weeks, Months or Years to setup recurring items. You can leave the Until field blank and items will recur forever, or select an end date for a series of items.

- Recurrence - Select 1 and Once Only for one-off items.

- On next working day - If you check this field, then the occurrence date for each item will be moved to the next working day, if the date falls on a weekend.

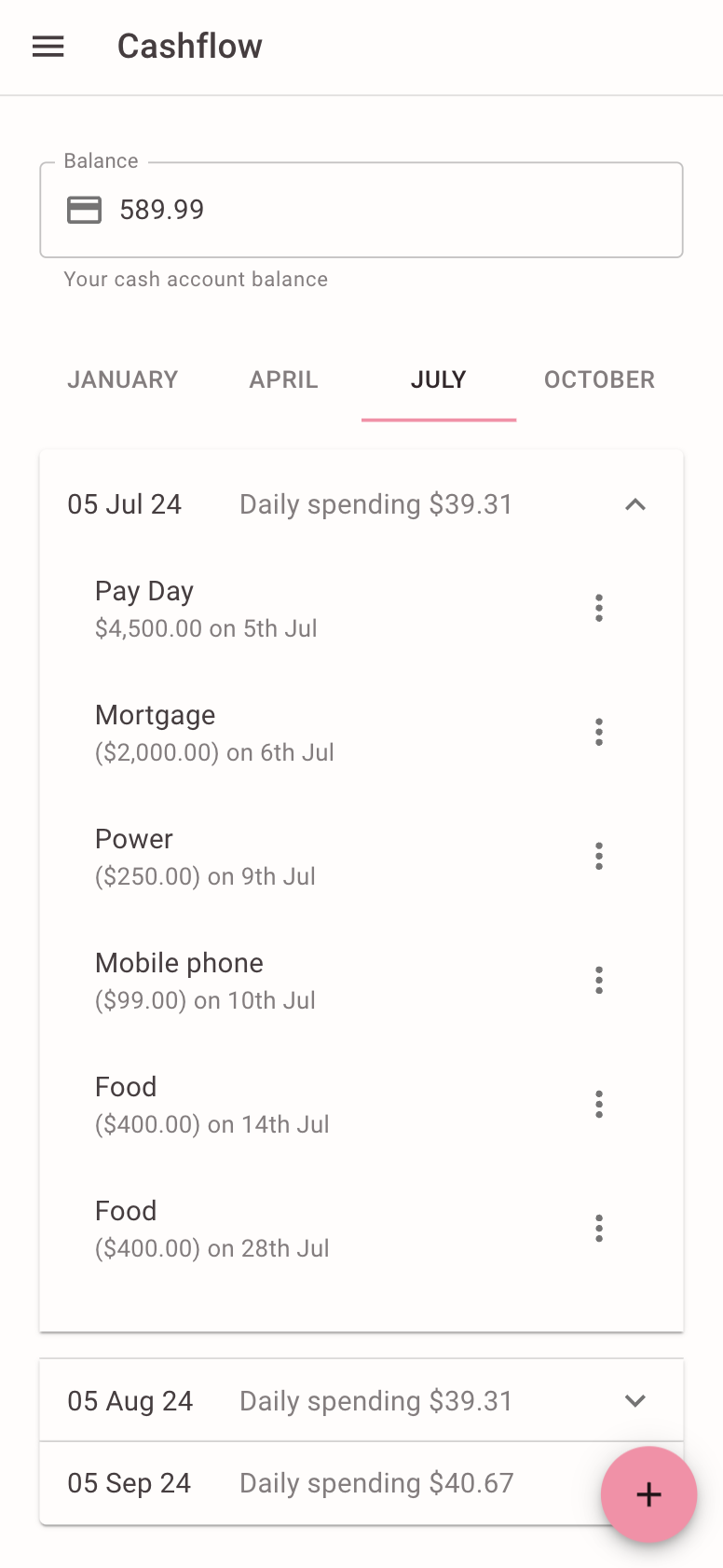

Reviewing Your Forecast

You can plan ahead by reviewing a 12 month forecast of your budget. Items can be added to any pay period and your spending money will be adjusted, so that you can see how your lifestyle will be impacted.

Your daily spending is averaged across pay periods to cover large expenses with less impact on your lifestyle. No more survivor Tuesdays...

By adding your savings goals, paying off debts, or covering larger expenses you can strike the right balance between living a great life today and building the lifestyle of your dreams.

Updating your forecast

Updating your forecast usually takes less than 5 minutes. Simply update your balance and delete items that have been spent. Note that "Delete All" will delete the budget item all together.

You can also make minor adjustments to individual instances, by clicking on "Edit". This will allow you to change the amount or due date for a single item.

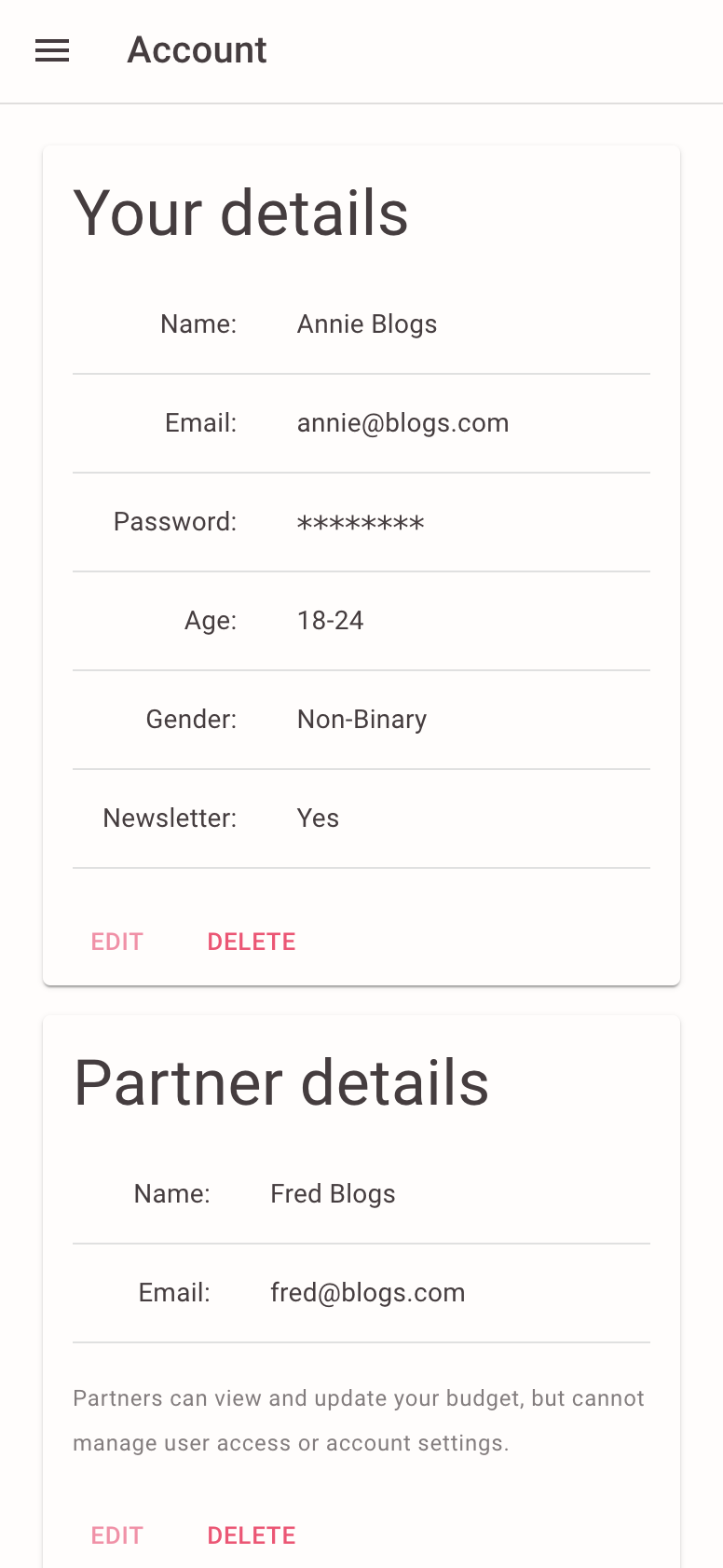

Account Management

On the Account page you can update your details and change your password.

If you are the account owner, then you can also add your partner to the account. Your partner can access and update the budget, but cannot add users or change account settings.